Insights August 2025: Employee-Ownership & Manufacturing

Also: warehouse execution systems strategy, construction updates

This month, we discuss strategic warehouse execution system implementations with Savoye–how to scale, how to match real-world processes. Additionally, the impact of employee ownership on manufacturing and its potential as a key to succession for small and mid-sized manufacturers. Also, more on industrial construction and the softening demand for manufactured products.

Savoye: What is a WES? Why Smart Implementation Makes All the Difference

A Warehouse Execution System (WES) is the operational “brain” of a warehouse—bridging between the strategic WMS and the equipment-level WCS. Best-in-class WES systems deliver this intelligence, orchestrating real-time operations to drive efficiency and adaptability.

Key takeaways

- Without the right configuration, integration and training, WES is just tech—and nothing transformative. Make sure your implementation focuses on processes, people and execution before technology and features.

- If you’re scaling, automating or facing omnichannel complexity, a WES is practically a necessity, but only if implemented smartly.

- Exceptional systems focus on simulation & testing, covering peak loads, downtime events and exception scenarios.

Industry Week: Employee Ownership Could Help Solve a Manufacturing Crisis

In this article, Industry Week argues that employee ownership could help American manufacturing solve the various and shifting challenges the sector faces. Currently, manufacturing faces instability in terms of labor markets, tariff policies and supply chain inconsistencies. Some manufacturing companies, particularly privately-owned ones, also face succession issues, with over 128,000 of them owned by people at or near retirement age. Given that manufacturing must deal with instability almost everywhere else, succession should be dealt with sooner rather than later.

Key takeaways

- Manufacturing owners should gauge and define their exit and succession plans to ensure their companies thrive after their departure. However, it’s a difficult time to value and sell a manufacturing concern due to the larger scale instability.

- A sell is one strategy, but employee ownership has advantages. Owners can sell their shares of the company either in full or part to employees through various channels. ESOPs (employee stock ownership plans) are one option, while EOTs (Employee Ownership Trusts) are another. These channels offer different types of advantages and flexibility.

- Positives for employee ownership offer stability, and help owners secure their legacies. They help attract and retain employees–a vexing issue for manufacturers. These vehicles are also excellent in terms of smoother ownership transitions.

Industry Week provides a quick guide to assess your situation in this piece, including a sort of self-quiz that might help you make up your mind.

Cushman & Wakefield: Construction Insights

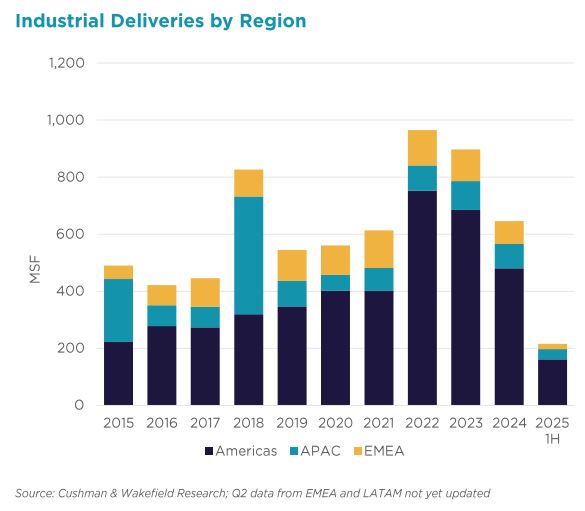

Above: industrial square footage construction deliveries by year, by region. American deliveries are at a ten-year low, preceded by a surge of deliveries from 2020 to 2024.

This Summer 2025 report breaks down the construction industry’s current situation. Of particular interest is the way U.S. industrial construction has trended following the massive surge of pandemic-era buildout.

Like warehousing and manufacturing, the industry is experiencing labor instability. Trade policy realignments are making planning more difficult for the industry as projects are delayed or flat. Energy costs are a bright spot, as they fell 11.3% quarter-over-quarter. 2025 industrial construction deliveries were about 175 million square feet, the lowest since 2015, as the market continues to absorb the surge of square footage delivered since 2020–a whopping total of over 2.4 billion square feet in manufacturing, warehousing, distribution and related industries.

Key takeaways

- Equipment costs are still rising – Construction equipment costs are up more than 25% since 2020, with a 4.2% increase year-over-year through Q2 2025.

- Tariffs are creating planning headaches – More than half of construction executives say tariff volatility is affecting pricing and planning. While lumber and steel costs aren’t climbing like in past cycles, uncertainty is causing delays and second-guessing.

- Backlogs are steady, not shrinking – Despite the noise, there’s still strong demand in the pipeline. Projects are being planned, but with longer lead times.

- Labor’s tight, and construction timelines feel it – Wages are leveling off a bit, but the bigger issue is retention and availability.

Videos: Panel Discussion: Facility Constraints – Expansion, Construction or Relocation

Quick hits

- In this LinkedIn post, Joseph Politano breaks down how manufacturing employment has changed since 2020. Manufacturing construction grew significantly between 2020 and 2025, but employment has been flat at 12.7 million since the pandemic. Beneath that, the data shows that some states lost manufacturing jobs while others gained them. States like Texas (8% growth), Nebraska (9.3%), Alabama (7.6%) and Nevada (18.%) grew. States like Michigan (-3.9%), North Carolina (-3.3%) and New York (-4.1%) lost manufacturing jobs.

- Savoye and Cisco-Eagle announced a strategic partnership in August. “By combining SAVOYE’s scalable automation technologies with Cisco-Eagle’s trusted system integration and regional market insight, we are uniquely positioned to deliver tailored, high-impact solutions to customers across North America,” said Savoye CEO North America Paul Deveikis.

- You can spend a lot of time delving into the ISM (Institute for Supply Chain Management) July 2025 reporting, but I focused on the manufacturing section. Here’s what we’re seeing in the sector in brief: American manufacturing is under pressure, with a PMI rating of 48.0. Demand remains soft for both new and backlogged orders. The sector is facing cost pressures, with rising prices (although not as rapidly as in previous months). Customer inventories are a bit on the low side, which signal supply chain adjustments.

Scott Stone is Cisco-Eagle's Vice President of Marketing with 35 years of experience in material handling, warehousing and industrial operations. His work is published in multiple industry journals an websites on a variety of warehousing topics. He writes about automation, warehousing, safety, manufacturing and other areas of concern for industrial operations and those who operate them.