New Rules for Industrial Automation ROI

What ROI factors should you consider? Things are changing quickly

In October 2019, I wrote this article on ROI factors for automation projects. That was just over two years ago, but the world is–to understate the case–a different place now. We endured a relentless Covid-19 pandemic that still persists. The “great resignation” has accelerated. Ecommerce demand was already ascendant, but is on an even faster track. The labor pool got shallower and continues to contract. What should we consider when we look at these projects in 2022 and beyond?

The fundamentals still–and always will–matter

While the environment has evolved quickly, ROI calculation fundamentals are still the core of any smart analysis. Those can include:

- Capital investment: solution deployment costs, including the costs of disruption.

- Ongoing costs: what does the solution cost to operate? How do those costs compare to current costs?

- Operational benefits: near future, half decade, and decade for payroll, training, maintenance and operations

- Opportunity costs vs. alternative investments: what else could you have done with that capital?

- Cultural impact on your employees: This one is critical–particularly today. Understand the potential affects and their costs.

- Competitive factors: how will the solution make you more competitive? What advantage does it give you over your competitors?

- Labor factors: how will the solution reduce your need for labor?

What’s changed–and how should that affect your thinking?

Old: labor costs. New: labor availability

Most companies who automate have always prioritized the cost of labor, but availability is today’s dominant factor.

The dynamic used to be “can I reduce labor to cut costs?” Today it’s “can I operate at all with the current labor requirements?”

The reality is this: you’re going to face escalating labor costs and reduced labor pools for the next decade or so. Shifting demographic trends laid this out years ago, but the pandemic seemed to supercharge it. You’ll be competing harder for fewer workers in 2022, and it gets tougher every year. The economic consensus is that the American labor force will shrink by 6 million between 2022 and 2030. Industrial sectors like manufacturing, distribution and ecommerce fulfillment may have it relatively worse than the rest of the broad economy.

Manufacturing is one of the most vulnerable economic sectors, with a projection of 2.1 million unfilled positions by 2030. The effects are already apparent: Central Freight Lines shut down in December 2021 primarily because it couldn’t hire enough drivers.

“We are seeing more use of AGVs, and robotic picking systems being added due to labor shortages. Also, positive flip is companies are repurposing labor to other value-added areas and replacing the long, repetitive transport tasks with AGVs, railed guided vehicles, etc.”

What’s happening in the labor markets?

Baby Boomers, the largest generation in American history, are retiring faster than they can be replaced. They are a disproportionately high percentage of manufacturing and industrial workers, so the impact will be felt faster and more deeply in these sectors.

Manufacturing is one of the areas where this is most pronounced. That was known pre-pandemic, but it’s faster-moving since because boomers are retiring faster than they were in 2019. Business conditions over the next decade will exacerbate that shortfall. The U.S. Chamber of Commerce reports that there were four workers for every available job in 2012. Today, that ratio has plummeted to just 1.4 workers per job. That ratio won’t get better anytime soon.

If you’re seeing these trends, it’s only the start. It may not be that labor costs you more in the next five years; it may be that you can’t hire people at all in some sectors and for some types of work.

Read more: Why Your Order Pickers Should be More Like Fast Food Workers

Why scarcity trumps cost

Costs matter and always will. Scarcity drives costs. There will be a point that you can push enough money at enough people to continue operating manually, but those costs are always on an elevator; you will never be able to predict or control them. Automation provides predictability.

As labor grows scarcer, companies that realize it sooner and automate sooner will be positioned to gain market share and customer confidence. Supply chain disruptions may not affect them as much as they have during 2020 and 2021. These are significant competitive advantages that mean much more than a reduced cost-per-unit metric. They mean you can do business when others may not be able to.

If you are operating on a scale that relies heavily on labor, your ROI calculations should primarily run through the prism of labor availability. You’ll need to find ways to operate with fewer people.

Old: focus on the savings. New: focus on customer service

Plenty of companies factor in customer service, but many make it a sidebar; a notation. It should be primary in today’s competitive environment. Everyone you compete with will be working to reduce their labor dependency just to stay up and running, but automation that makes you faster and more accurate may return its investment simply because it helps you capture and retain customers better than manual, slower processes.

- Does the automation help you ship and deliver faster?

- Will it make you more accurate?

- Can it reduce your error rate?

- Would it let you target more markets and stretch your reach?

- Is your workforce safer and more productive because of the automation?

- Could your customers tell the difference between your service before you automated and after?

Read more: Order Fulfillment is the First Line of a Great Customer Experience

If your solution allows you to serve more customers, reach more markets and expand your footprint, the costs shrink in relation to the value.

Old: make your best guess. New: Simulate to zero in on the facts

Knowing is better than guessing, and ROI has always been something of a guessing game.

Knowing is better than guessing, and ROI has always been something of a guessing game.

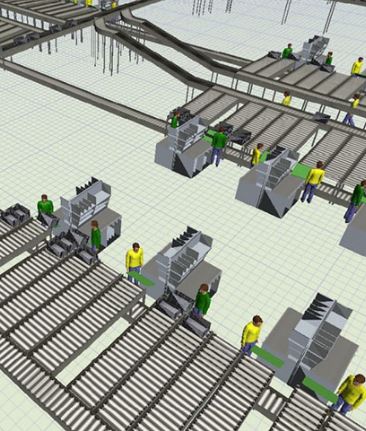

You approach it with at least some error rate in mind when projecting costs and gains. Project simulation won’t alleviate that uncertainty, but could reduce it. It may help you visualize things that you can’t see without it. You may want to simulate the entire operation or just critical aspects of it to give you deeper understanding of the process and its impacts, both upstream and downstream. For complex projects, simulation tends to add significant value.

Simulation requires data collection and forethought, but these steps alone can often be worth the time. You’ll need all the data from both the old process and the proposed changes to get started, and that will take time and effort. You’ll need to fully understand the current process steps before you can simulate the new one. Finally, you should be able to simulate improvements that can be understood through the simulation.

Simulation gives you a critical tool: the ability to communicate upstream to management when you pitch the idea. It doesn’t matter how much a proposed automation solution will help if you can’t get buy-in from stakeholders in your organization who don’t understand why you might need it, or why it’s more important than competing projects in other departments. Come with data, come with facts, and come with a visual representation that everyone can understand.

If your solution requires buy-in from the c-suite and others who don’t understand your operation, simulation may help you and others understand the project’s ROI much easier.

Automation isn’t all-or-nothing

Automation comes in more than one flavor and can range from a single point-of-function that processes work and passes it along to lights-out warehouses with few employees. Adding automation like picking software or pick-to-light to a manual process can have dramatic impacts. Layering in mechanical solutions that convey and sort products, packaging and labeling machinery or picking equipment add another layer of automation. Pick modules can be impactful by reducing floor space usage and consolidating operations. AS/RS, carousels, robotics, palletizing and software solutions can all be factored in either as a total solution or pieces of the puzzle.

Old: Safety is bonus. New: safety is a primary ROI factor

Safety has always mattered, particularly to smart companies that understand the potential liability and broad negative impacts of systematically unsafe operations. When the work is dirty, dangerous, inherently non-ergonomic and difficult, it was always a critical automation factor. Today, that’s more important than ever because people will simply veer away from working those types of jobs. If they’re constantly lifting, twisting, turning, and pushing through awkward, injury-prone work, they’re more likely to leave it for something safer and easier.

Safety and a comfortable work environment are critical employee retention factors. Automation can help you retain more workers and reduce the inherent injuries and risks in industrial operations.

Retaining workers is critical, even for automated warehouses. Safe, ergonomic work will help you retain your workforce in the face of escalating competition for it.

Old: indirect ROI factors are less important. New: More consequential than ever

Direct benefits–the kind you can measure in time and dollars–are the easiest to define, prove or disprove because you can easily assign costs and returns in hard dollars. They’re easier to explain to your CFO. The problem is that indirect benefits may be more valuable cost-driven ones.

While indirect benefits don’t always show up on balance sheets–at least not directly–they’ve become more important because many of them are directly focused on labor. Things like ergonomics, injury rates, space savings, training and education factors, employee churn, product damage and improved security reduce ongoing operational costs.

For example, it’s harder to define ROI for reduced space consumption because it depends on what you do with that square footage. If you can forestall a new facility or reduce walking to the point that pickers are faster and more accurate, what’s the value? If the space is assigned to activities that don’t directly return hard benefits in a definable way, what kind of ROI would you anticipate?

Can you define the value of a thing that didn’t happen as easily as you can define the value of things that have? When functions are automated, how can you re-task headcount? How can you define the value of fewer injuries? What’s the value of staying in the same facility for more years rather than moving or expansion?

The more things change, the more you need to know

ROI is changing because the economic environment around us has changed, as tends to happen when there are major shocks to the system. Certainly these labor trends are troubling, but the challenges aren’t insurmountable for companies that work strategically to cope with them. Part of your plan should include exploring ways to reduce the number of people necessary to serve your customers and accomplish your mission. Automation is part of that mix, but certainly it’s not the only part.

Scott Stone is Cisco-Eagle's Vice President of Marketing with 35 years of experience in material handling, warehousing and industrial operations. His work is published in multiple industry journals an websites on a variety of warehousing topics. He writes about automation, warehousing, safety, manufacturing and other areas of concern for industrial operations and those who operate them.