Warehouse Automation: The Cost of Doing Nothing

When is inaction more expensive than action?

People who operate industrial facilities have a difficult task. While the world changes around them, they’re dealing with a static operation that can be difficult to change or revitalize. Sunk costs, funding and organizational inertia can paralyze you at the worst moments. But the reality is that from our supply chains to labor to our customer demand profile, things are always in flux.

These complexities are growing, and with that growth, the need for change is underlined.

- Energy: the good news for American manufacturers and distribution companies is that energy is a stable factor. America has become a net energy exporter, with a surplus of natural gas. We have some of the best energy prices in the world.

- Labor: This is where we run into issues. It’s very likely that any company of size in any American market has faced a labor crunch. That crunch is only going to worsen.

- Customer and market demand: This is usually specific to sectors, but in general we have all seen markets and demand change over time. Operational flexibility is key.

- Supply chain complexity: If you deal with multiple vendors and subcontractors for either inventory or manufacturing inputs, you introduce both flexibility and vulnerability into your systems.

These factors frequently hinge on good data. Do you have real-time information to help you make decisions? Is the data you have reliable?

The cost of inaction can be high

Automation is expensive. It’s costly to diversify your supply chain. It’s costly to optimize an operation so that it can quickly adapt to changes in labor, land, energy or external factors (political changes, economic performance, inflation or labor difficulties).

But it’s more expensive in many cases not to make changes.

Understanding opportunity cost is essential in making informed choices and assessing the true cost of decisions

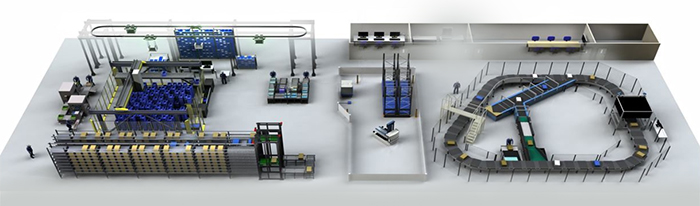

Opportunity cost is an economic concept that refers to the value of the next best alternative that must be forgone when a decision is made to allocate resources (such as time, money, or labor) to one option over another — the cost of choosing an option vs. other options. For a distribution center, the costs may be the potential gains you can attain by automating a pick module or conveyor system or AGV deployment vs. the gains that money could realize elsewhere. Automating a process has an opportunity cost that must be evaluated. That money could have gone to other aspects of the company to realize overall better ROI.

It could also simply be retained, with capital reserved for better options down the road. Automation isn’t always the right answer, but when it is, what are the risks of inaction?

Understand your goals – at every level

According to Nils Hart, of Murata Machinery, a global manufacturer of AS/RS systems, AGVs and automated handling technologies, “the cost of doing nothing goes back to what what you’re trying to achieve. What are the metrics you’re trying to improve?” Hart says that this involves studying the situation, not just with an eye towards justifying the automation but on what your alternatives could be. “If you are looking at an operation that can thrive for five years, it’s okay to do nothing.”

But when is nothing preferable to action? Some factors that affect that are listed below.

Projecting future shortages: labor

“I would still look at the total value of benefits,” Hart continued. “Because there are concerns you can fix today that may be much harder to fix in the future. Labor, for instance. We see companies automating today that have adequate labor but foresee a crisis in five years.” In these cases, companies that can operate in the environment they see in 2024 effectively are taking employment trends into account and understand that labor will be more expensive and in shorter supply over the next decade than it is today.

Quick projections: labor in the late 2020s

- America’s aging population will result in a significant labor shortage in various sectors as a larger share of the workforce approaches retirement age. The U.S. Census Bureau says that 25% of manufacturing workers are 55 years or older. The replacement generation simply isn’t large enough to fill those positions.

- Rapid technological advancements are creating a skills gap between the skills workers possess and those demanded by industries. This skills mismatch is likely to lead to shortages in fields that directly impact warehousing. The industrial sector will compete with other sectors for a contracting pool of labor. It’s going to cost more to train the next generation of workers, as many are simply not as skilled as the departing generations. Even as you automate, you’ll need to consider the technical skills required to run that system.

- A reduced influx of foreign labor will exacerbate labor shortages, particularly in industries like manufacturing, agriculture and construction. Mexican labor is essentially tapped out for the foreseeable future, as Mexico is also seeing a boom in manufacturing construction.

- Cultural factors may play a role, as generations of younger Americans shy away from trades and manufacturing employment.

- Onshoring and the manufacturing construction boom are creating higher demands for labor in the sector, even as labor pool contracts.

“Labor is a big concern in Texas,” said Cisco-Eagle President Bryan Gauger. “At the same time, we’re seeing growth and new manufacturing plants entering the state every week.”

The cost of money

Most economists predict some level of inflation over the next decade, although 2024 looks to have milder inflation than recent years. The St. Louis Federal Reserve predicts an inflation rate of 2.5% in 2024, which aligns with Goldman Sachs’ prediction of 2.4%. This of course is on top of the 9.59% CPI in 2022 and other inflationary pressures over time.

- The Federal Reserve has effectively used interest rates to slow inflation, and may still do so in the future.

- Manufacturing and warehousing operations will face higher interest rates over the next decade due to liquidity rates driven by demographics.

- If the average predicted inflation rates from 2025 through 2030 are accurate, cumulative price increases will reach 25.15% by 2030.

- The cost of doing nothing also means that if you do need to act, the price will be higher in future years.

- Other predictions, based on demographics and capital costs, availability and the need to source manufacturing domestically, predict that specific inflationary pressures in the manufacturing sector may outpace that of the general economy.

Costs, lead times and availability for industrial automation projects

The pace of new manufacturing construction in the United States is well documented. That construction alone will fuel inflation in general by absorbing land, material, labor and energy. But for companies that are considering automation. Those companies will be competing with new operations for suppliers, material and limited amounts of expertise in the market and may face costs higher than the general inflation rate indicates. Lead times are another issue.

For industrial projects, during higher demand phases, lead times for automation equipment and plant materials may be much longer than usual. Plans may need to be in place years before action is taken to guarantee supplies. Critical materials may be months or years out as supplies tighten and activity increases.

While predicting inflationary cycles five years in advance is–at best–a guess, it is safe to say that we will see higher prices for steel, labor, software and energy over the next decade. It’s safe to say that the sunk cost of an automated system in 2024 will be lower than in 2028.

Risk, reward and the costs of inaction

The decision to act commits us to a course of action but so does inaction. Failing to take action often leads to missed opportunities and worsening problems. Inaction can perpetuate poor processes and locks us into systems we cannot easily change. If your operation suffers from structural problems, you’re likely to see those increase without action to change them. While proactive plant expansions, automation or process changes can be costly, the costs of inaction may be higher.

Embracing proactive measures and taking steps towards positive change is not only a way to minimize these costs but also a pathway to a more efficient future that gives you more control over the outcome.

Tags: AS/RS, conveyors, labor management, Robotics

Scott Stone is Cisco-Eagle's Vice President of Marketing with 35 years of experience in material handling, warehousing and industrial operations. His work is published in multiple industry journals an websites on a variety of warehousing topics. He writes about automation, warehousing, safety, manufacturing and other areas of concern for industrial operations and those who operate them.